In June of 2022, Tempus launched a new investment vehicle called Tempus Evergreen. This investment is our private Real Estate Investment Trust with predictable cash flow, conservative capital structure and high-quality buildings. Many investors are familiar with REITs, but we envisioned creating an investment that is structured with significant differences from many of the large institutions in the commercial real estate industry. Evergreen, our private REIT, is composed of properties located in a diverse set of markets rather than the common few gateway markets that companies like Blackstone or KKR choose to exclusively invest in. For example, KKR’s KREST REIT geographical breakdown is 60% in the East/West gateway markets and the rest in a select few gateway markets such as Philadelphia, Chicago and Atlanta. If you look at Blackstone’s BREIT, which is the world’s largest REIT, the breakdown is almost identical to KKR’s.

The common theme for large institutions is to deploy capital only in the major metropolitan areas. An investor looking for a diversified approach to private real estate is all too often over-allocated to the largest markets in America and significantly underexposed to the rest of America. In many instances, investors are fully reliant on the top ten largest markets to generate all their real estate returns. We believe that most opportunities available to individuals from large institutions fully neglect the added benefits of diversification across middle America markets. At Tempus, we use our extensive relationships and decades of experience to invest in secondary markets with a middle America focus to allow investors increased geographical exposure across the U.S. while owning assets at more attractive valuations.

Why Middle America:

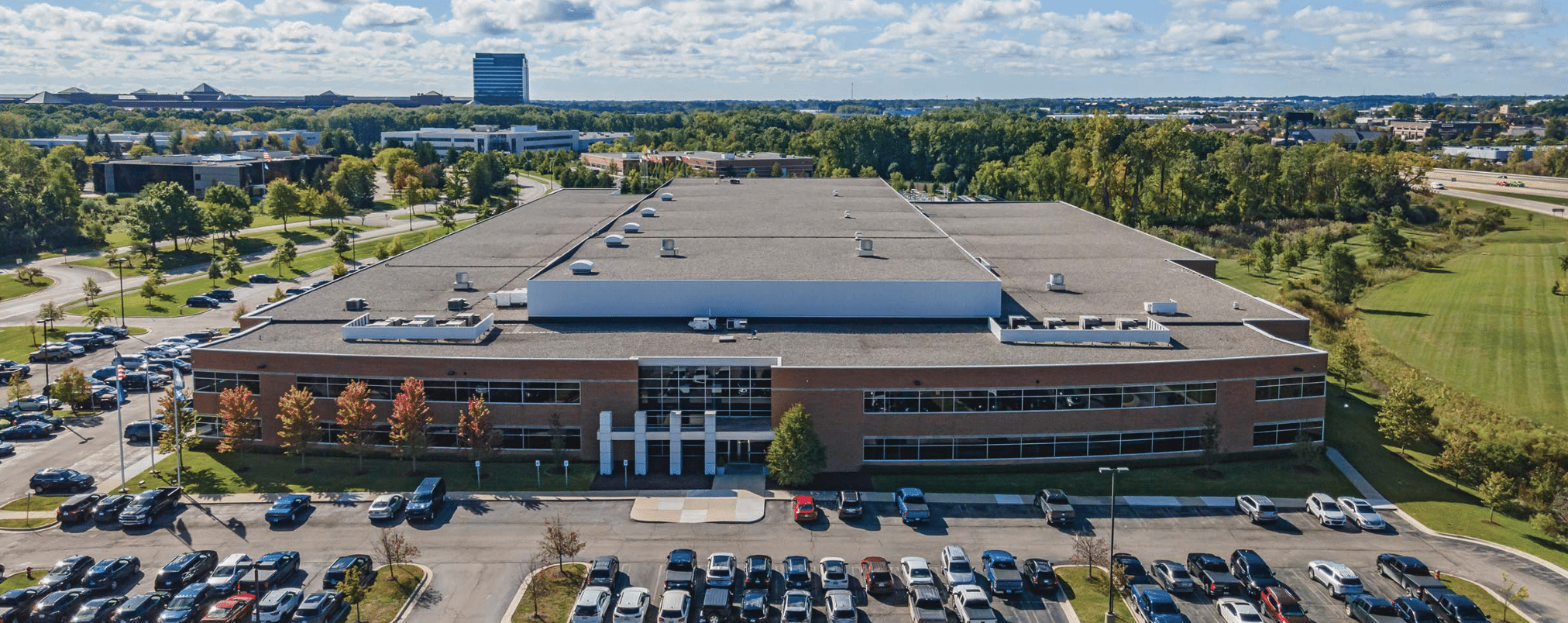

For Tempus Evergreen, middle America happens to be the markets with positive employment and migration trends. Additionally, these markets have lower valuations and less volatility than many of the major coastal markets. The headlines in the news today regarding real estate discuss some office property valuations being cut in half, or companies defaulting on loans. Most of these headlines are related to properties in cities ranging from San Francisco to Baltimore. On the contrary, secondary markets like Grand Rapids, Michigan and Northwest Arkansas, where Evergreen owns properties, are flourishing and remain insulated from many of the headwinds. The middle America approach is not an easy one for large institutional firms to enter. In many markets we invest in our deep relationships and long-term commitment to the areas that have opened opportunities to invest in off-market assets. These markets can be too burdensome for large institutions to invest in due to the fragmented nature of middle America and the investment size not meeting their needs. Evergreen directly benefits from the Tempus relationships by getting access to trophy assets in markets where economies are flourishing and property values are rising.

Tempus Evergreen Structure:

We believe predictable value can be created from being diversified across asset types and markets and using fixed rate debt. While many companies like Blackstone or KKR choose to pursue some blend of floating-rate financing and fixed-rate financing, Evergreen’s investment strategy is to utilize fixed-rate debt while increasing our lease term as far into the future as possible. This provides our investors a predictable and growing stream of cash flow from strong tenants while mitigating exposure to interest rate swings. Currently, Evergreen has a weighted average lease term of over 14 years across all our tenants and 5 plus years of fixed rate debt, 300 basis points below today’s market rate. Since its inception, Evergreen has outperformed both the NCREIF private market fund and the NAREIT Public Equity Index and has done so with less volatility along the way. Evergreen is comprised of almost 50% solid credit, single-tenant industrial assets with retail and single-tenant office properties as well. These are just a few of the examples of how Evergreen distinguishes itself as a REIT with a different approach than many of our peers in the industry.

Keith Mathews

Financial Analyst